Building your dream home just got a whole lot simpler. A land loan through Greater Nevada Credit Union is the perfect solution for lot sizes up to 10 acres. Apply online or call us to get started!

Land Loans

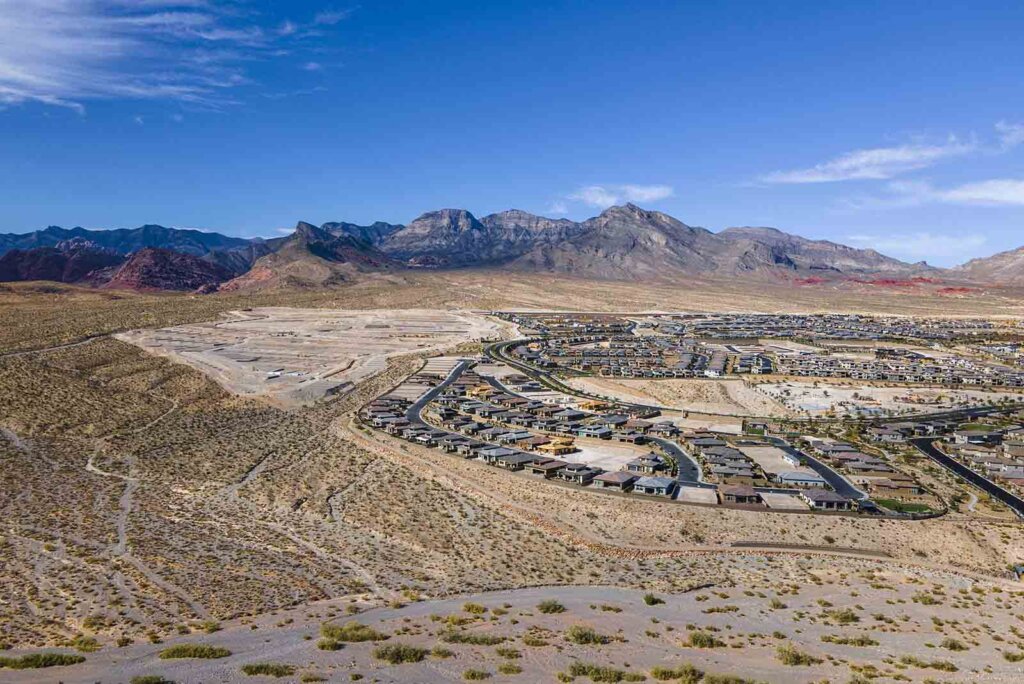

Secure Your Nevada Lot for the Future

Vacant Land & Lot Loans

If you’re looking to invest in a piece of land in Nevada with intention to build a home, then look no further than Greater Nevada for financing options. Our land loans (also called “lot loans” and “vacant land loans”) come with competitive rates and terms–all for your convenience as you build your vision.

Why get a land loan with Greater Nevada? Put simply, because we offer a Greater lending experience: an easy application process, great rates, and personalized support from local loan experts. Here’s what you need to know about land loan requirements through us.

Location

The real estate you want to purchase must be located in Nevada.

Utilities

All the utilities must be on-site with access to a publicly maintained road.

Zoning

The land must be zoned as residential property, plus the intended use of the land must be to build a home in the future.

Lot Size

There is no minimum lot size, but the maximum is up to 10 acres large.

Repayment

Take advantage of competitive rates and terms, with repayment terms up to 180 months.

Amounts

Loan amounts are a minimum of $10,000 and up to 75% of the appraised value of the land.

Let’s Buy Your Land or Lot

Applying for a land loan is as simple as going online or calling our lending hotline for assistance. Let us answer your questions and guide you through the process!

Difference Between Home Loans and Land Loans

Though these two lending options may sound similar, they’re actually quite different and you will need to plan accordingly. Home loans are traditional mortgages and include the purchase of land and a home (or other residential structure). Land loans are for land without any structures.

As with most loans, a higher down payment can net you lower interest rates. Higher interest rates may result if you don’t put down enough, or if you have less-than-optimal credit. Contact your local branch to learn how else you can get competitive terms on your next land loan!

Land Loans

For applicants wanting to purchase land without structures or homes.

Terms

Up to 180 Months

Traditional Mortgage

For those wanting to purchase a house and the land on which it was constructed. For these, we turn to Greater Nevada Mortgage, GNCU’s home lending subsidiary, who can help with mortgage needs anywhere in Nevada and California.

Terms

Terms Vary by Mortgage Type

Frequently Asked Questions

Let’s turn your land dreams into reality. Get the answers to all your questions about borrowing for your piece of the Silver State below (or contact us directly for more details).

-

Is it hard to get a loan to buy land?

As with most loans, you’ll need to qualify before a lender will approve you for funding. That means having a decent credit score–around 640 or higher. Interested to see where you stand with your credit report? Members can take advantage of our free My Credit Health feature within Digital Banking offering a powerful one-stop-shop to access your credit score, credit monitoring, credit score simulator, financial tips, and more. All of this without impacting your credit score, and all online.

-

What is the lowest down payment for land?

The short answer: it depends. The long answer: no two borrowers or pieces of land are the same. Therefore, no minimum down payment will be universal.

Apply for a Greater Nevada Credit Union Vacant Land Loan

Apply for your land loan and turn your dream home into a dream reality! Contact us, go online, or book an appointment for in-person guidance.